A Mess Free Life may collect a share of sales or other compensation from the links on this page.

Worrying about money is something we’ve been trained to do since we were children. Our parents and grandparents worried about money, and although they probably didn’t intend to teach us to do the same, we still learned the habit.

But money worries can be some of the most stressful worries that we deal with because they usually affect every aspect of our lives.

Worrying about money means we’re worried about how to pay our bills, how to afford groceries, what happens if we lose our job, and what if there’s an emergency that we haven’t saved for.

Money worries have many harmful effects on our daily lives.

When we worry about money we spend so much time focused on that stress that we’re unproductive and don’t get anything else done.

Sleep becomes restless, that is if you’re able to even get any. Stress leads to health problems like headaches, high blood pressure, muscle aches, and even ulcers. And money related stress can strain even the best relationships causing fights, tension, and distance.

It’s clear that worrying about money is not good for you, but how do you stop? If you’re not making enough or don’t have enough, you’re reminded daily of this lack and the stress continues.

Table of Contents

HOW TO STOP WORRYING ABOUT MONEY

Before we talk about getting a handle on your financial situation so that you don’t worry, let’s talk about how to get your mindset in the right place.

Because here is what I know to be true – as long as your mindset is in the wrong place, it’s going to keep your struggling and broke. Fixing your mindset gives you the freedom and flexibility to finally break free of the cycle of debt and create a new life.

During the early years when I was struggling and debt I learned this valuable lesson first hand.

When I was constantly stressed and worried it made it difficult to think of solutions to the issues at hand.

When I was finally able to change my money story and create a new dynamic, I found getting out of debt easier than I had before.

Continuing to worry about money will only cause more worry and stress in other areas of your life as well. The worry causes your mind to focus on the wrong things so your productivity slows down and so does your thinking.

When your mind is clear and free of stress, it opens you up to more ideas and thoughts that can help to move you past your money worries.

Switch your focus to the things that you are grateful for, like your family, friends, and health.

Focus on how grateful you are that you have a home and food on the table. These are the things that matter most and focusing on these things will help to get yourself in the right frame of mind and reduce your stress.

Each time you begin to worry about money, just quickly switch your focus and start counting your blessings. It will help you to calm down.

Now that you’re in the right frame of mind, it’s time to figure out how to stop worrying about money.

ASSESS YOUR FINANCIAL SITUATION

Before you can start working on how to fix your situation, you need to know exactly where you stand.

Lots of folks think not knowing is better than knowing the real numbers behind the debt.

But believe me when I tell you the only way to fix your finances is to know exactly what and who you owe so you can develop a concrete plan on how to get out of debt.

This will help eliminate the worry you have over money.

You need to get a handle on what you owe before you can start to tackle it. When you’re not really sure how much you owe and how much interest you’re paying, it can cause stress.

Getting a clear financial picture puts you in control of your situation instead of letting it control you.

Gather all of your credit card statements, loans, and bills.

Using a spreadsheet or a legal pad, write down every company you owe, the total amount you owe, the term of the loan if applicable, and the minimum monthly payment.

Use the forms we’ve created for you that can be found in the free resource library. Just click the link below to gain instant access to our free budgeting tools.

These are the same tools I used to get out of debt so I know they’ll help you too!

Total the overall amount you owe and the minimum monthly payments so that you can see the big number as well as what you need to pay each month.

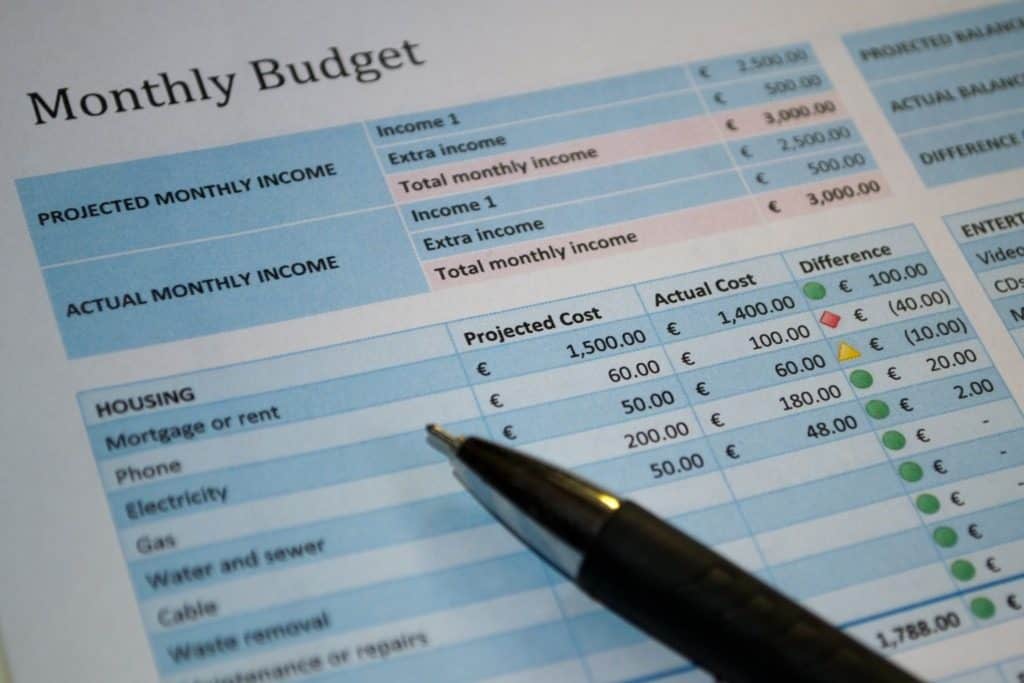

DEVELOP A BUDGET THAT WORKS

If you already have a budget, it may not be working if you’re worried about money.

If you don’t have a budget, it’s time to start one. Either way, start a fresh budget working with the numbers you’ve calculated.

Start with your necessities, rent or mortgage, utilities, groceries, insurance, auto expenses. Then add in your monthly payments for your loans and credit cards.

Finally add in your extras like entertainment, gifts, and dining out.

Calculate the total amount you need each month to balance your budget.

If your expenses are more than your income, it’s time to make some cuts.

Look at your cable bill; can you get rid of premium channels? Or maybe you can cancel cable altogether and get a streaming service instead. Are you still paying for a landline? If so, do you really need it?

Maybe you can reduce your car payment by trading in your newer car for an older model. Getting out of debt is more important than a nice car or premium cable.

And once your debt is paid off, or even paid down, you can always upgrade again.

COMMUNICATION IS KEY WHEN YOU’RE A COUPLE

Communicate openly with your partner about how you got into this situation and how you can get out of it.

It’s important to be honest about how you feel and look at your situation together. You will both need to make sacrifices to get out of debt so you need to be in it together.

Take a look at what you’re both spending and where some of your impulse buying habits are taking over.

Decide which one of you will be in charge of handling the budget and paying the bills each month.

But keep in mind, just because one of you has that responsibility doesn’t mean the other shouldn’t know what’s going on. Sit down at least once a month to look at your budget and review your bills together.

REDUCE YOUR SPENDING

The best way to pay down debt so you can stop worrying about money is to reduce how much you spend.

Challenge yourself to a “no spend month”, making meals from only what you have in your pantry and not buying anything other than what you absolutely need.

It’s difficult, but it’s just for a short-term and the extra money can go towards paying down your biggest debt.

We offered a No Spend Challenge a few years ago and people reported great success. You can find the entire challenge here.

But a word of caution: If you are really struggling with emotional spending, a no spend challenge may not be the best choice for you. Learn why I think a no-spend challenge is the wrong idea for emotional spenders and what you can do instead.

CONCLUSION

The best way to stop worrying about money is to get a handle on it. Worry comes from NOT facing the known. When you know what you’re up against, you’re in control of how you’ll handle it.

Work together to create a budget, reduce your spending, and cut your expenses so you can stop worrying. It’s good for your health and good for your relationship.