A Mess Free Life may collect a share of sales or other compensation from the links on this page.

The first article in my series on Love Your Money, we dug into the importance of Saving Smart.

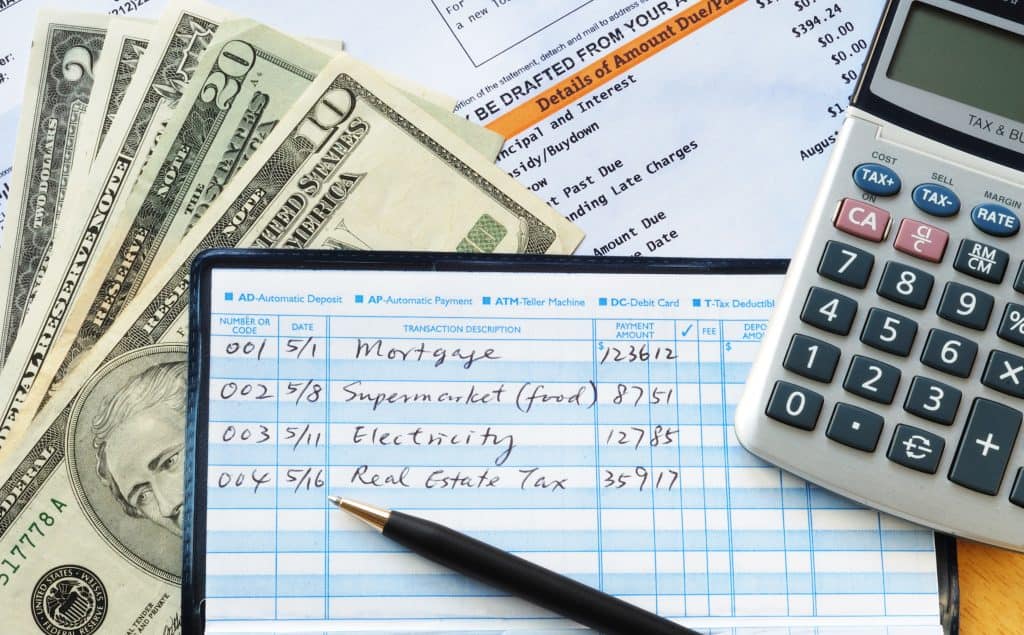

Today, I want to discuss developing a spending plan.

The other day I received an email from a reader asking for suggestions and help with paying off her credit card debt. As we moved through the conversation, it became apparent that she didn’t have a workable spending plan (budget). We scheduled a time to chat on the phone so I could get her on the right track, develop a spending plan and see what might be holding her back emotionally.

Most people hate the word budgeting. It sounds restrictive, kinda like the word dieting.

We live in a society that’s all about getting what you want at all costs. Feeding the beast of consumerism is wrought with problems too numerous to mention in this article.

But what budgeting comes down to is living within your means.

Learning to live within your means takes practice and the sooner you develop your budget or spending plan, the sooner you’ll embrace the concept and become a successful budgeter.

Think about this. In a 2013 Gallop Poll only 32% of Americans used a budget to plan their spending. That means over 60% of Americans routinely spend more than they can afford.

Hence why we have so much credit card debt.

A budget isn’t intended to punish you, make you miserable or force you into a savings frenzy. It’s to keep you financially well, safe and prepared for the future. It’s about keeping your long-term goals in the forefront, not on the back burner.

So how do you accomplish this task of learning to love your money and build a better budget?

Developing A Spending Plan

1. Wants vs Needs

When developing your spending plan, the best way to determine your wants and needs to ask yourself a series of questions.

You need to evaluate your current situation and ask yourself what you really want and need. Look at the big picture here.

Make a list – one for wants and one for needs. As you create your list, ask yourself:

- Why do I want it?

- How would things be different if I had it?

- What other things would change if I had it? (for better or worse)

- Which things are truly important to me?

- Does this match my values?

- What will I need to live happily and comfortably in my retirement?

2. Establish Guidelines

We all have different wants and needs and so our budgets will be reflective of these differences. How much should go to different expenses will be based on certain factors. If you’ve got children your budget will be reflective of those additional expenses. If you’re heading towards retirement and have downsized your home, your budget will be indicated those changes.

No matter how you determine these factors and expenses, ultimately your budget needs to balance and hopefully reflects money put into savings.

3. Add Up Your Income

To set up a monthly budget or spending plan, you need to know what’s coming into your household. Include all sources of income such as salaries, interest, retirement accounts, Social Security, Pensions, side jobs, and any other income sources.

4. Determine Expenses

The best way to accomplish this task is to write down every penny you spend each month. Tracking your spending to see where your money is going and then to categorize needs and wants. Use the Spending Plan in the Free Resource Library.

5. Determine the Difference

Once your spending plan has been created, keep records of actual income and expenses. Keep tracking. It’s the only way to be able to determine the difference between the estimated and actual expenses.

6. Track and Trim

Once you start tracking, you may be surprised to find you spend $50 a month on coffee or on too many gifts for the grandkids. Some expenses are easily trimmed. Cutting back is usually a better place to start than completely cutting out. Be realistic. It will help you to be better prepared for unexpected costs.

To help you get started feel free to use the Expense Tracking Forms you can find in the Free Resource Library.

If you really want to give money the respect it deserves, develop a spending plan. Learn even more about the spending plan development process by going to my Spending Plan Series.

Learning to love your money is a step by step process. At the end, you’ve got the tools and resources you need to develop a solid financial plan that keeps you and your family safe.