A Mess Free Life may collect a share of sales or other compensation from the links on this page.

When you hear someone say, “I live paycheck to paycheck,” what immediately comes to mind?

If you’re like most people, you’re thinking it’s a middle-class family, struggling to make ends meet, cutting coupons and feeding their kids tuna casserole.

While this is true for some people, it’s not true for everyone living paycheck to paycheck.

But to reveal the entire picture, let’s examine what it looks like in the US to live paycheck to paycheck and who’s living that way and why.

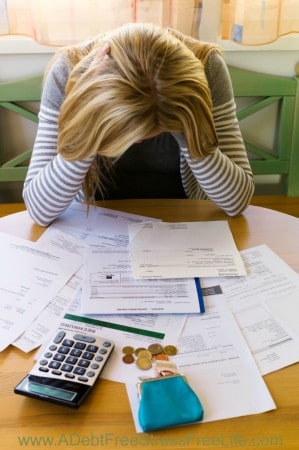

According to a survey from SunTrust that was conducted by Harris Poll, about one-third of US households earning at least $75,000 annually say they are living paycheck to paycheck. Essentially living on the edge and one paycheck away from financial disaster.

25% of households earning at least $100,000 are finding themselves pinching pennies too, stating they sometimes live paycheck to paycheck.

Fewer than one in four Americans have enough money in their savings account to cover at least six months of expenses which would help to cover the blow of a job loss or medical issue. Meanwhile, 50% of those surveyed have less than a three-month cushion, and 27% had no savings at all.

Related: How To Prepare BEFORE Financial Disaster Strikes

Haven’t we learned anything from the last financial disaster?

Public policy experts like to focus on widening income inequality and stagnant wages as to why the middle class is unable to make ends meet. But truth be told, it’s got to do with overspending.

Of the participants surveyed, 68% pointed to splurging on lifestyle purchases such as eating out and shopping as they reason they had trouble making their paycheck last. Millennials were worse at 70%. And, as a result, they’re not saving as much as they should.

So despite their adequate income, people struggling to make ends meet suffer from a discipline problem directly related to a spending problem.

But, what about the other folks who see themselves as living paycheck to paycheck – what are they doing?

Why Living Paycheck to Paycheck Isn’t Necessarily A Bad Thing

Many people do live paycheck to paycheck; I’m one of them. I’m not flat-out broke, but I wisely allocate my money to all the necessary buckets. I cover my expenses, but I make sure to put money into my emergency fund and for my retirement.

There’s more of us out there.

We don’t run around announcing to the world: “Hey, I’m living within my means, I don’t live high on the hog, but I’m financially secure, I enjoy life, I sleep well at night.”

In reality, living within your means (and living well, within your means), should be celebrated! It should feel a lot more successful than it does for some people.

In there lies the problem.

Instead of seeing the success of living within your means, living paycheck to paycheck, it’s seen as a failure. If you feel you’ve got to deprive yourself of anything, then you’re failing.

Related: 11 Habits of People Who Are Debt Free

All the right habits of putting money away for a rainy day, protecting yourself with the right insurance, paying off your home faster or being debt free doesn’t give you the sense of accomplishment that it should.

Instead, you’re focused on what you don’t have.

My friend once told me she that even though she knew she was doing all the right things with her money, the fact she couldn’t just run out and buy that new handbag she had her eye on, upset her. Living within her means and paycheck to paycheck was still seen as a negative.

Why do we insist on comparing?

That negative feeling, instead of the high of your accomplishment is directly related to comparing yourself to others. All that comparing makes you anxious, or envious, or sometimes dumb if you try to keep up with the Joneses.

[tweetthis]When we compare, we rob ourselves of the feeling of contentment.[/tweetthis]

Related: Comparison Is The Thief of Joy

But how do we stop comparing?

To be content, you need to swap lies for truth. You need to find the right things to compare your finances against. Instead of focusing on the Joneses, you can benchmark yourself against people who share your habits and values. Use it as a tool to do better with your finances, not to gain more stuff.

The world is forever pointing out things that should be ours, creating in us a sense of entitlement. If we focus on what’s lacking or how we can’t buy that handbag we’ve had our eye on, we’ll forever be discontent.

There’s no question that my friend and I are wealthy women.

Related: How To Love Your Money: Saving Smart

I’ve been able to pay my bills, put money aside, and never worry or stress over debt. I could go out and buy something if I wanted to dig into my savings. Instead, I put into my spending plan and save for what I want. I feel very fortunate to be living within my means and living paycheck to paycheck.

Now if my friend could only see it that way.