A Mess Free Life may collect a share of sales or other compensation from the links on this page.

If you’re in financial survival mode and can’t seem to save a penny for “a rainy day”, you’re not alone.

Many people believe it seems futile to bother to save when you’re staring at credit card statements that have sky-high interest rates or student loans that will take a lifetime to pay off.

The thought you should put money aside each month just feels overwhelming.

It’s not that you don’t want to save, you just don’t know where to begin and how to move past the feelings of discouragement you have about saving.

How do you learn to love saving money and why should you care?

Table of Contents

The Joy of Saving

THE STATISTICS

In a recent personal finance article on CNBC.com approximately 57 million American’s don’t have an emergency fund with the majority of those without a fund hitting the young baby boomer who is 53 to 63 years of age.

This hit is a result of the long drawn-out financial crisis and the lack of employment opportunities for people who fell into this age bracket.

This isn’t news to many of boomers who found themselves unemployed from high paying jobs and never found work or a salary even close to what they were making previously.

I have countless friends who tried self-employment and failed as well and most if not all of them completely drained any savings they did have to keep their heads above water and to remain in their homes.

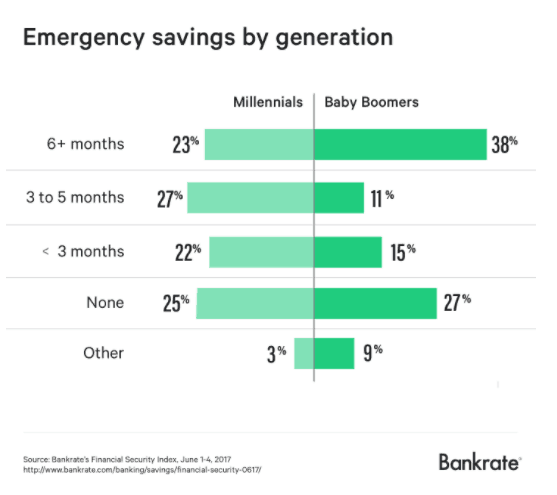

Here’s the breakdown according to Bankrate.com.

Where do you fall? Do you have at least six months of expenses saved in an emergency fund?

Learning to save money is crucial to getting out of survival mode.

It’s what helps you to begin to break the cycle of debt because you now have a savings account from which to handle emergency situations.

Related: How To Reach Your Financial Goals This Year

WHAT THE PAST REVEALS

But truth be told, most of us were not taught the value in saving.

We might have been told to save, but not given the guidance or direction to understand its value.

You probably have some early memories of saving money.

Maybe you had a piggy bank that your mom or dad “borrowed” from only to never repay you.

Maybe you invested some money only in seeing the fees you were being charged were more than what you were making on your investments.

Either way, you may have adopted the “why to bother” attitude to saving money.

While it would be nice to review all the memories that stood in the way of learning to save adequately, we must get to a place where we are ready to let go of our old beliefs as being impossible, worthless or vague; and instead, begin to embrace the joy of saving.

In my article The 6 Steps To Saving As A Means of Getting Out Of Debt, I highlight the method one should use to begin to save and why saving your way out of debt is a smart choice for most people.

Getting out of debt and saving go hand in hand.

You can’t do one without the other.

Not having a savings account is the number one reason people get into debt and stay there.

They don’t have the available resources to handle whatever life may throw their way.

DON’T TOUCH

Many people have this belief that you should never touch your savings account, and if you do and you end up depleting it to pay for an emergency situation you’re a big, fat, failure.

The problem with this thinking is believing there’s only one way to save.

There are different types of savings depending on what your intention is for the money.

Read: How To Prepare BEFORE Financial Disaster Strikes

We should have to have three types of savings: short-term emergency fund, long-term emergency savings, and investments.

1. SHORT TERM EMERGENCY FUNDS

The most significant resource you can establish if you want to break out of the debt cycle.

This fund is for non-monthly, periodic expenses that come up as your car needs a repair or the water heater blows.

These types of life circumstances are bound to happen, and when you can go to your short-term emergency fund to cover the expense instead of using a credit card to pay for it, you’re breaking the debt cycle.

But periodic savings aren’t always about saving for something ho-hum. This account can be used to save up for a vacation, a new mattress, Christmas gifts; anything that’s not part of your regular monthly expenditures.

This account can be used to save up for a vacation, a new mattress, Christmas gifts; anything that’s not part of your regular monthly expenditures.

You include a certain amount into your spending plan each month and deposit the money into your account. This money is to be used guilt-free as it intended purpose is to help you avoid credit card debt and save for the things you want.

This money is to be used guilt-free as it intended purpose is to help you avoid credit card debt and save for the things you want.

Read: How To Prepare BEFORE Financial Disaster Strikes

2. LONG TERM EMERGENCY SAVINGS

If the economic and housing crisis of 2008 taught us nothing else, it’s that every American needs a long-term emergency savings fund. If the countless people who lost their homes and jobs had a safety net such as this, they might have fared better.

If the countless people who lost their homes and jobs had a safety net such as this, they might have fared better.

This fund is to be used and only used when there is a loss of income. It can be due to job loss or illness or a reduction in work hours or loss of business income. It is never to be used for any other reason. This is the fund between you and being homeless.

It can be due to job loss or illness or a reduction in work hours or loss of business income. It is never to be used for any other reason. This is the fund between you and being homeless.

It is never to be used for any other reason. This is the fund between you and being homeless.

I didn’t have this fund when I lost my job in 2002. My cleaning business was an overnight success and as such I made the money to keep me from losing my home. But if it hadn’t been for my luck, things would have turned out far differently.

My cleaning business was an overnight success and as such, I made the money to keep me from losing my home. But if it hadn’t been for my luck, things would have turned out far differently.

But if it hadn’t been for my luck, things would have turned out far differently.

The exact amount you should save into this fund will depend on a variety of factors.

Some financial folks like Dave Ramsey say you should save a minimum of three to six months of expenses.

Personally, if we were to have a repeat of the financial crisis of 2008, that wouldn’t be enough for most people.

Read: How To Get Out of Debt {And End the Debt Cycle Forever}

3. INVESTMENTS

Investments are an important part of your overall financial picture.

But if you’re only putting money into investments (which is what I did), then if you find yourself unemployed or fall ill, you’ll be in big trouble.

With that being said, no one wants to get to the end of their life and have to eat tuna every day because they can’t afford to live comfortably.

Recently I received a message from a woman asking for specific advice for seniors who need to get out of debt.

She’s 67 and can’t even think about retiring.

What will this woman do?

If she has no savings and no retirement, how will she survive as she gets older?

It’s frightening to think about this and to imagine her circumstances.

You don’t want to end up like this with little to no options.

Don’t end up this way.

Start saving your way out of debt, build your emergency and long-term savings and fund your retirement.

Work out the details in your spending plan.

Read: Good Money Habit #10 – Develop A Monthly Spending Plan

CONCLUSION

The stress and worry of not having what you need when you need it can be minimized or simply eliminated by maintaining an emergency fund.

Go and open up a savings account and make a commitment to put some money in there each week. Don’t have much to spare? Start with $5.

If you don’t know where you’ll find the money to save read: How To Save $10,000 This Year or The Best Saving Strategies When You MUST Save Money. There are easy to follow ideas for how you can find money so you can build your emergency fund.

The way I saved was by setting up automatic transfers from my checking account. You can do it easily with programs like Digit.

In essence, what Digit does is use an algorithm to detect spare money and then transfers it to a secure savings account – so you’ll always have something to fall back on.

I tried the program myself and within four months I had saved above and beyond what I normally save, an additional $500!

If you have an emergency fund, you just use the cash you’ve saved to solve whatever problem is being thrown at you.

Rather than it becoming a crisis, it seamlessly goes away because of your advanced planning and good judgment.

If you don’t have an emergency fund, start one.

Yes, you will possibly have to make some significant sacrifices to accomplish this task, but the alternative will be far worse for you and your family.

By focusing on your savings strategy, you’ll eventually find the joy in saving.