A Mess Free Life may collect a share of sales or other compensation from the links on this page.

When reviewing my blog topics the other day, I realized I hadn’t spent any time talking about budgeting.

I call my budget a spending plan because it’s fluid and is always changing based on what’s going on in my life at the moment. But for the sake of this post, I’m going to call it a budget.

Sometimes I forget that some people still don’t live on a budget. That was me many years ago. I never knew what I had coming in and what was going out and if I could even meet the demands of my expenses.

So I decided to write a post for all the people who stare aimlessly at the computer spreadsheet, feeling like an idiot, wondering what the hell they are supposed to do.

Here’s A Crash Course In Budgeting

1. Get Your Income and Expense Statements Together

Gather all your check book registers, pay stubs, bills and other statements that will give you a solid view of your current financial situation. If you do a lot of bill paying on-line, print out your current payee list or leave a screen open on your computer as you evaluate your situation.

If you have a spouse or significant other, make sure they’re involved too.

Sit down and start crunching numbers. You can crunch numbers with just a piece of paper and pen, if you’re not the fancy type, or just do this step in an excel spreadsheet.

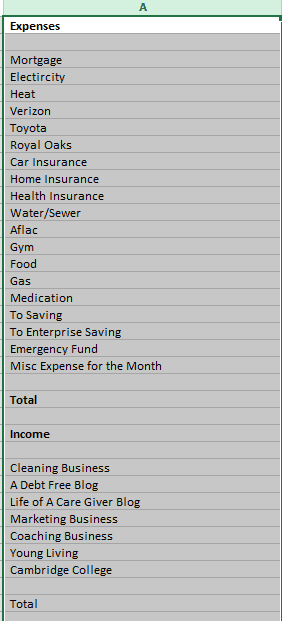

This is a copy of what’s on my spreadsheet that I use at home.

I use a basic system; nothing complicated at all. It’s a list of my expenses and income – period.

I don’t think you need 3, 4, or 10-page documents when setting up a budget And if you’ve been resistant to setting up a budget, a simple plan will probably work much better for you in the long run.

I love using an excel spreadsheet because it does all the math for you. When you input the math, it makes the deduction or subtraction for you and you’re always on top of your numbers.

If you’re using paper and pencil method, I highly recommend setting up your budget in excel for both ease of use and ensuring your math comes out right.

Read: The 6 Steps To Saving As A Means Of Getting Out Of Debt

2. Determine Variable Expenses

What usually kills most budgets is the variable expense that occurs each month that you forget about. Mom’s birthday in June, along with a baby shower in July and your in-law’s anniversary, can take a perfectly balanced budget and throw it in a tailspin.

Grab a calendar and a determine those variable expenses that don’t occur with any particular regularity month to month, but do show up regularly in the year.

The one variable expense that would always get me each year was my excise tax on my car. It would occur in April, along with my tax bill and I would be scrambling around looking for extra cash to pay the tax. I grew to hate the month of April.

Once you have all your variable expense mapped out, compare the totals of your income vs. your expenses. Is your expense number higher than your total income?

If it is, you’ve got some changes to make because you don’t have enough income to support your expenses. If you keep on living as you’re living, you’ll keep using credit cards to make ends meet. You’ll never get out of debt, and you’ll be in the same mess or worse this time next year.

Deciding what to cut comes from your variable expenses, not your fixed expenses. You have to pay your rent, lights, heat, etc. You can’t change how much the loan on your car is, or your mortgage. That’s fixed too, although you can do things maybe down the road, that’s not what I’m talking about here.

Look at your variable expenses, the going out to eat, going to the movies, gifts, vacations.

[tweetthis remove_twitter_handles=”true”]All the stuff you can’t afford, but continue to buy as if you can. That’s what you’ve got to cut.[/tweetthis]

Read: How To Manage Your Bills So You’re Never Late Again

3. Make Sure You Balance Out

Add up your total expense and compare it to the money coming in from your income. Does it add up? If not, go back to the drawing board and look at other items you can cut from the budget until it does add up.

If you notice in the example, I showed you all of my income comes from self-employment income with the exception of the income I earn from Cambridge College when I teach. I don’t teach every semester. Sometimes I teach twice a semester and other times, like this summer, I don’t teach at all. It’s a BIG difference.

What I’ve learned to do is live off my cleaning business income. That income is pretty fixed each month and I know I can pay all my bills on this income alone. The rest of my income allows me to reach other financial goals like paying off my mortgage sooner, funding my grandson’s college fund and saving for a beach house!

Because I don’t spend the “bonus” money recklessly, I’m guaranteed to meet my financial obligations each month. If you’re ever in a position to do this with your income, I highly suggest you do the same thing.

Read: Create A Budget That Bends And Finally Stick To Your Plan

4. Be Honest

Getting out of debt and learning to live on a budget requires a level of honesty that may be missing. You’ve got to get real with yourself about your finances and be willing to make the necessary changes that will put you in a better financial position.

You can’t keep overspending and expect things to change.

If you feel living on a budget is too restrictive, I’ve got one thing to say about that: too bad, get over it.

I know it might not feel great in the beginning, but if you could do it without a budget you’d already be in a better position, right?

Listen, I’m not an accountant, lawyer or financial advisor, but I am a woman who has made a ton of mistakes with my money. It’s taken me years to get it right. I don’t want you to make the same mistakes I made.

Now is the time to do something about your budget.

So get out your computer, open up excel and start budgeting.