A Mess Free Life may collect a share of sales or other compensation from the links on this page.

Table of Contents

5 Best Budgeting Apps

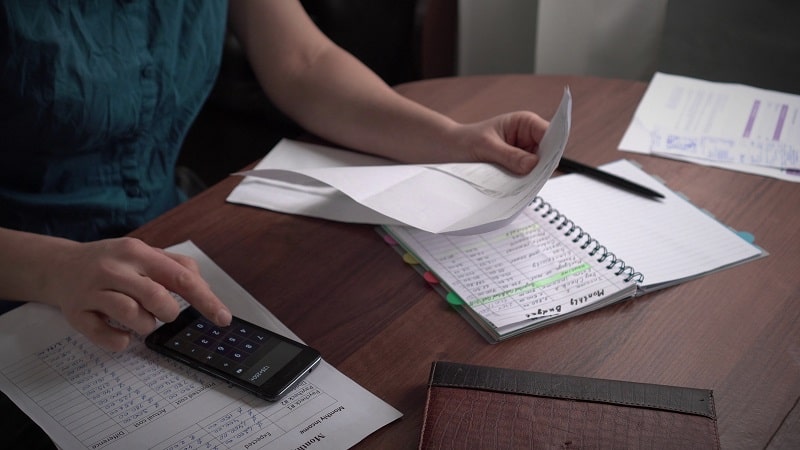

Do you feel it is time to take control of your spending, by tracking where your money goes each month?

You’re not sure how, but you know it would be helpful to track your upcoming bills and avoid late payment penalties of overdue bills.

Honestly, managing your expenditure doesn’t seem easy. But you understand that it is your job to maintain a healthy financial status.

Fortunately, the tech world takes notice that nearly everyone desires financial order. There is a steady stream of monthly bill tracking apps to lend a hand.

You want a monthly bill tracker tools that can pinpoint areas you`ve been spending cash, track upcoming bills, keep you up with credit scores, and also go as far as investing in a portfolio.

Put a monthly bill tracker app on your smartphone, and you’ll never wonder about where your money goes.

We’ve scraped the deepest financial corners of the web. We have found and brought to you here some of the world’s best monthly trackers available on both Android and iOS platforms.

Let’s get started.

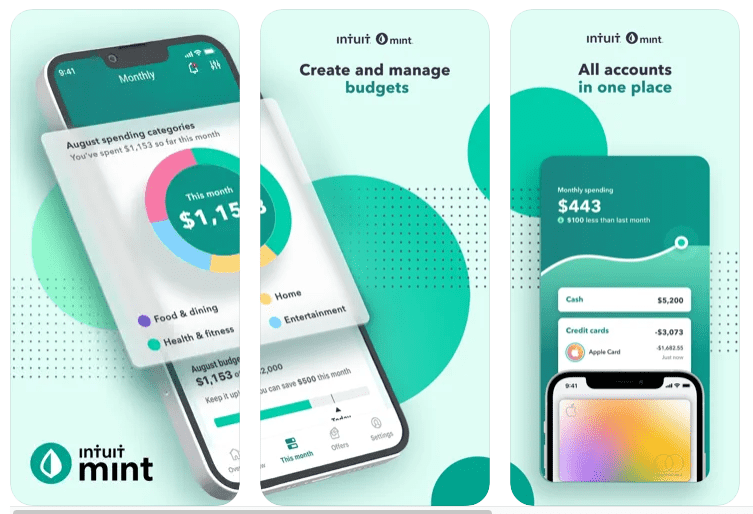

1. Mint

This monthly bill tracker from Intuit has a global reputation of bringing users’ a complete financial picture in one place.

First, Mint is a free app. One less expense for you to track.

Secondly, all you need is to link your credit cards and debit card to your account, and the tool does the hard work for you.

Mint pulls your transactions, categorizes them, and shows you how you spend your money.

Thirdly, it allows you to keep track of your bills and spending patterns. You can create an easy to follow budget.

The bonus feature you’ll get from this app is the free access to credit score, a utility that helps you monitor and maintain your credit health.

And that isn’t all with credit scores.

The Mint app goes ahead and presents to you a breakdown of the factors that contribute to your credit score.

Even more, the app empowers you to track your investment and schedule utility payment. For bills that require manual payment, the app will send you email reminders or add due dates to your phone calendar.

As if that isn’t enough, this cost-free app is accessible on any smartphone as well as a computer.

Read: Evaluating a Debt Relief Company

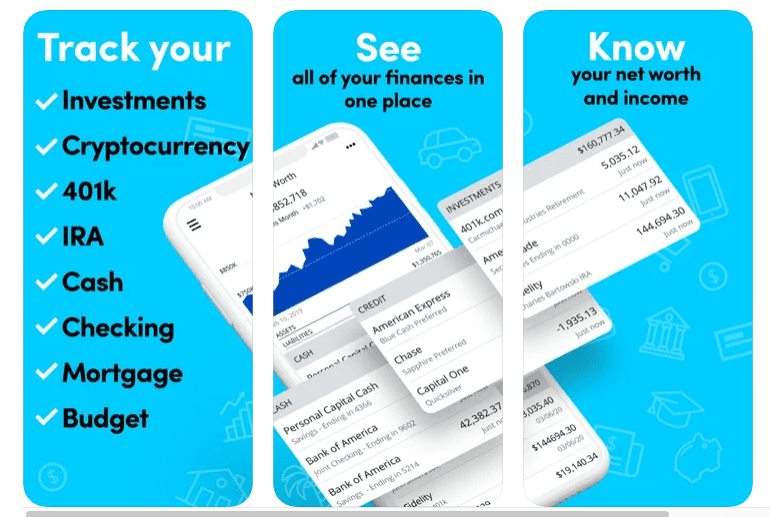

2. Personal Capital

This is a monthly bill tracker appropriate for wealth management.

Besides keeping an eye on your monthly bills, this Personal Capital app allows you to manage your assets and investments. It integrates with over 14,000 financial institutions so that you can link any account from the app.

You can then connect your bank account and track all your monthly spending and craft a budget.

The unique feature with the Personal Capital app is the utility that allows users to track and optimize on investment. It utilizes your portfolio by account, asset class, or individual security to allow maximum optimization on investment.

If you are using the tablet version of this app, you have access to financial web options and are presented with opportunities for diversification, risk management, and reveal to you any hidden fees you might be paying.

Most of all, you’ll be able to compare your portfolio to the primary market benchmark so that you can check if you’re on track to meet your investment goals.

What’s more—and this is unique—Personal Capital will connect you with a registered financial advisor who will offer personal advice to suit your goals.

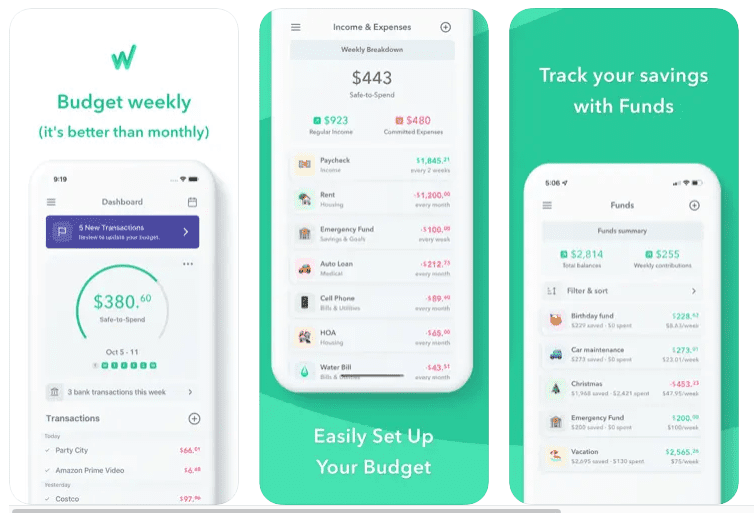

3.Weekly

Take a left turn and manage your monthly bills weekly.

Weekly aims to rethink how you budget by breaking down your discretionary spending into weekly chunks. Then it provides a beautiful easy-to-use spending tracker. It can connect automatically to your bank and pull down transactions.

To set up the app, you put in your regular income and recurring bills. From there, Weekly will determine how much you can safely spend each week. Why a week? Well, we operate in our lives on a weekly basis. We have work weeks and weekends. It’s just more natural to think about spending weekly.

Weekly also doesn’t overburden you will categorization. The idea is to be light and easy to use but also accurate. When your monthly bills come in, you map them to the recurring bills you have already setup in the app and they don’t affect what is in your “Safe-to-Spend”.

Finally, you can setup “Funds” to save for the things you want. So if you want to save $50 a week for your birthday fund, that will automatically lower your weekly “Safe-to-Spend” amount so you can keep on track to your goals.

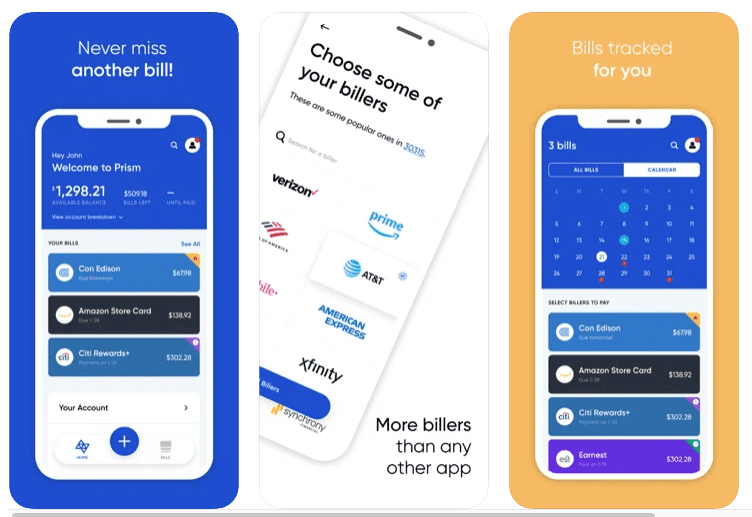

4. Prism

If you’re exclusively searching for a bill payment platform, then this is the best app for you.

Prism shows you all your bills and financial accounts in a single app, giving you a clutter-free picture of your finances.

The app collaborates with over 11,000 billers—a collaboration that is considerably more expansive than any other app on the planet today. Prism has created partnership ranks, even with smaller utility companies.

All you need is to add your bills on the app, and Prism will automatically track your bills and send you due date reminders to help you prevent late payments.

You can also schedule bill payments on the exact date every month or several days in advance to avoid late payments.

The ease of this app eliminates the need to log in to multiple accounts paying bills.

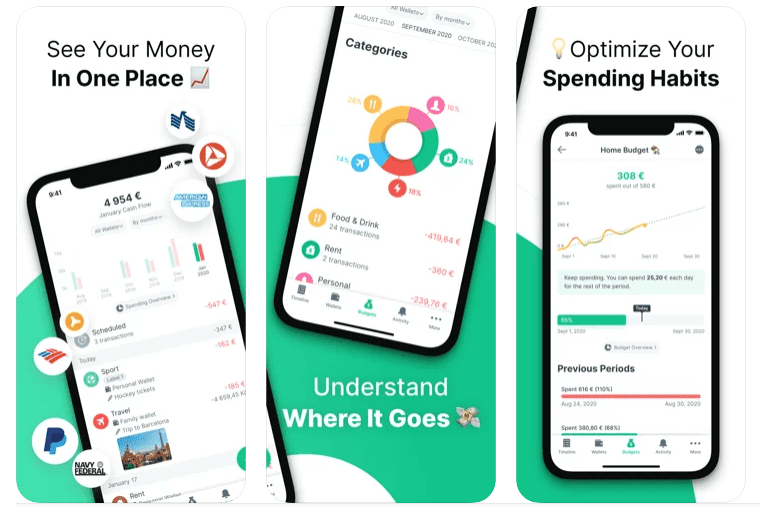

5. Spendee

Are you looking for a monthly bill tracker for an entire household or a tool you share with family and friends? Meet Spendee the perfect fit.

First, Spendee allows you to create a shared wallet that is also accessible by friends and family, as needed.

You import your bank transactions and let the app categorize and tally how you spend your money each month.

Secondly, to create a clearer financial picture of where your finances are going, you can manually add cash expenses. There is an included feature for all expenditures executed by each family member.

Thirdly, and most importantly, the app has a bill tracker utility that ensures you pay your bill on time and avoid late payment penalties.

Lastly, if you’re going for a trip or scheduling a special event, you can create a category specifically for that trip or event. This app will help you track and stay within your budget.

So if you want to effectively track expenses, get email reminders, track subscriptions, and make a savings plan for something down the road then a monthly bill tracker is the best way to reach your financial goals.