A Mess Free Life may collect a share of sales or other compensation from the links on this page.

Living paycheck to paycheck can be a stressful experience when each month you struggle to manage your money without going over your budget. But the reality is everyone who has been in the situation of living this way has at one time or another gone over and found themselves with overdraft fees or worse.

If you are living paycheck to paycheck, there are a few budgeting tools I recommend to help you get out of debt and have a clear picture of what’s going on each month with your money. I used one of these tools myself when I was getting out of debt, and it worked perfectly for me.

The secret here when choosing which system to use is to ensure its user-friendly to YOU. Just because your friend uses one application or system doesn’t necessarily mean it’s right for you. But if you’re confused any one of these three methods should do the trick. If you’re ready to get out of “panic mode” and start controlling your budget, read on…

How To Track Your Budget When You’re Living Paycheck to Paycheck

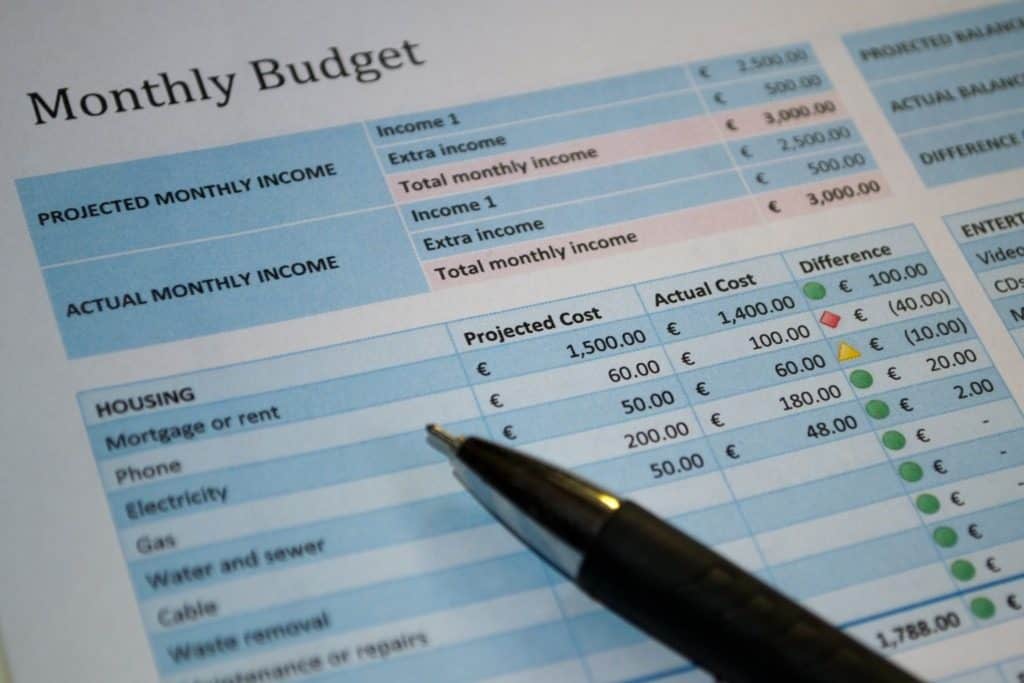

The first step to creating a budget is to put it all down on paper. Getting it down on paper is crucial in helping you see where your money is going. The process of creating that first budget in this manner allows you to form a bond with your finances in a way that won’t happen if you just immediately start using some fancy application or system.

You can use a simple excel spreadsheet too if that seems easier than pen and paper, but I recommend the old fashioned way first.

Many of the life planners on the market today have sections for budgeting that you can also use. My Living Well Life Planner has sections for budgeting, and I love the ease of having it right at my fingertips.

But after you’ve done paper budgeting for a while you may find that you like the ease of use of a budgeting app. Maybe you want to be able to track it all on your phone or like managing it on your computer. When that day comes there are three programs I recommend.

Calendar Budget (was free, now charges $3.99 per month)

You Need A Budget – YNAB ($60 For Life)

Every Dollar ($99 per year)

Last but hardly least you can grab the Spending Plan/Budget templates available in the Free Resource Library.

If you don’t have the access code, just sign up below to be given the code. Check back often because I add to this resource library all the time.

Calendar Budget Is My Top Choice If You’re Living Pay Check to Pay Check

When I was getting out of debt, I didn’t have the money to spend on a fancy budgeting app, so I scoured the internet and found Calendar Budget. It was a life saver for me! I was at the point in my journey that I was ready to transfer from paper and pencil to a program and this was the best choice for me.

Why Calendar Budget?

When you’re living paycheck to paycheck timing is the essential element in making your budget work so you don’t get overdrawn, and find yourself with overdraft charges or having to resort to credit cards.

Traditional budgets look at each month in its entirety. It translates this into I have $5000 coming in and $4000 worth of bills leaving me $1000 to pay off debt. At face value, there’s nothing inherently wrong with this thinking until you start applying this method of budgeting when you’re living paycheck to paycheck.

When you’re living paycheck to paycheck timing is crucial. If you get paid twice a month, you need to remember when that money is coming in so you can plan when it goes out of your bank account. Make a mistake with this, and you’re staring down late fees and shut off notices. It becomes increasingly more difficult to manage because the stress takes a toll and has a tendency to help us forget what’s going on and the timing of it all.

That’s why Calendar Budget is such a lifesaver for people who live paycheck to paycheck. It helps you track when money comes in and when money goes out. You can put life events in the calendar too so you know when you need money for the Christmas Tree or mom’s birthday present. You know the specifics because Calendar Budget allows you to put that information right into the system!

How To Use Calendar Budget

Step 1: Create a free account.

Step 2: Enter a starting balance.

You’ll more than likely have outstanding charges, items that haven’t yet cleared your account. You can make a not of this, itemizing these things so that you know what your real balance is and not what is showing in your account at present.

Step 3: Create budget categories.

Grab your paper budget and put the categories in place. You can watch this video for more clarification.

Step 4: Enter monthly bills.

When setting up monthly bills, I would put “EST” in all capitals to indicate an estimated expense, not one that had actually been paid. You can do this and then delete those entries once the bill has cleared your checking account. This way you can easily see what is still outstanding and what has been paid. Put this into the appropriate day for when each bill is due, not when you’ll pay it but when it’s due.

Step 5: Enter your income.

Enter pay dates into your calendar.

Step 6: Assign budget categories to dates.

Look at the categories and how your money flows and assign dates for categories like food, or gas based on when you can afford to spend the money.

Step 7: Set Recurring Expenses.

Go back and set any expense that is reoccurring, likely all of them so that you have a basic budget created. You’ll need to go in and tweak it each month based on what’s happening for the month if you decide to reduce a variable expense (food, gas, etc.) and if you have other expenses that must be covered like a birthday or holiday event.

What’s great about this tool is you can look and see your budget in the future and know when you’ll be debt-free or when you might be ahead by a month on all your bills. The tool becomes a powerful motivator in helping you reach your financial goals.

Step 8: Update

Get in the habit of opening up the tool and updating anything that needs updating each day. Some days you won’t need to tweak a thing and other days you will. But if you get in the habit of looking at this tool each day you’ll begin to have an excellent handle on your budget. Once you feel confident, you can update weekly but if you miss a week, go back to daily until you have established a habit of checking your account/budget.

Next, you’ll want to download your bank account activity. Most banks allow you to download in either a Quicken or Microsoft Money format. Either will work. Save to your computer.

Now open up Calendar Budget and upload that file you just saved. All your transactions will appear. You can now drag and drop each into the date you made a purchase and assign a category for each purchase. When you do, you’ll see the numbers in the category change reflecting the purchasing and updating your budget.

What’s Next?

Remember, credit cards are no longer an option for you now that you are paying off debt and have a budget that is working for you. Consider converting to cash to help you adjust. Even though you’re living paycheck to paycheck this system allows you to afford anything you want – it just needs to fit into your budget.

You also need to start saving. Make sure you put away a portion of money each month for your emergency fund. Once you have established your emergency fund you’ll be ready to set up automatic payments through your bank but please don’t do this until you have at least $1000 in savings.

From there you’ll be ready to upgrade to YNAB or Every Dollar. Both have advantages for people who have mastered the art of budgeting.

If you’re ready to get out of “panic mode” and are ready to take control over your budget and finally get off the roller coaster of never really knowing where your money is going or when, then this system will fix that for you, but only if you use it.

You read this article because you need help. Don’t stop there, create an account in Calendar Budget and start mastering your money today!

MY FAVORITE MONEY-SAVING TOOLS

EBATES: Want to earn cash back when you shop online? Ebates acts as a shopping portal offering coupons and cashback from over 2,000 online stores. I always check on Ebates first whenever I shop online! You can join Ebates for free and get a $10 welcome bonus when you sign up through this link.

DIGIT: Like the idea of saving but need something automatic? Digit is the perfect solution if trying to automate your savings strategy. In essence, what Digit does is use an algorithm to detect spare money and then transfers it to a secure savings account – so you’ll always have something to fall back on. Sign up for free!

GROCERY BUDGET MAKEOVER: Is your grocery budget giving you a serious kick in your families spending plan? Grocery Budget Makeover helped my family slash $6,000 a year from our food bill! Learn more about how Grocery Budget Makeover can help you save money too!